How Chainfynex Token Is Revolutionizing Corporate Finance and B2B Payments with Blockchain

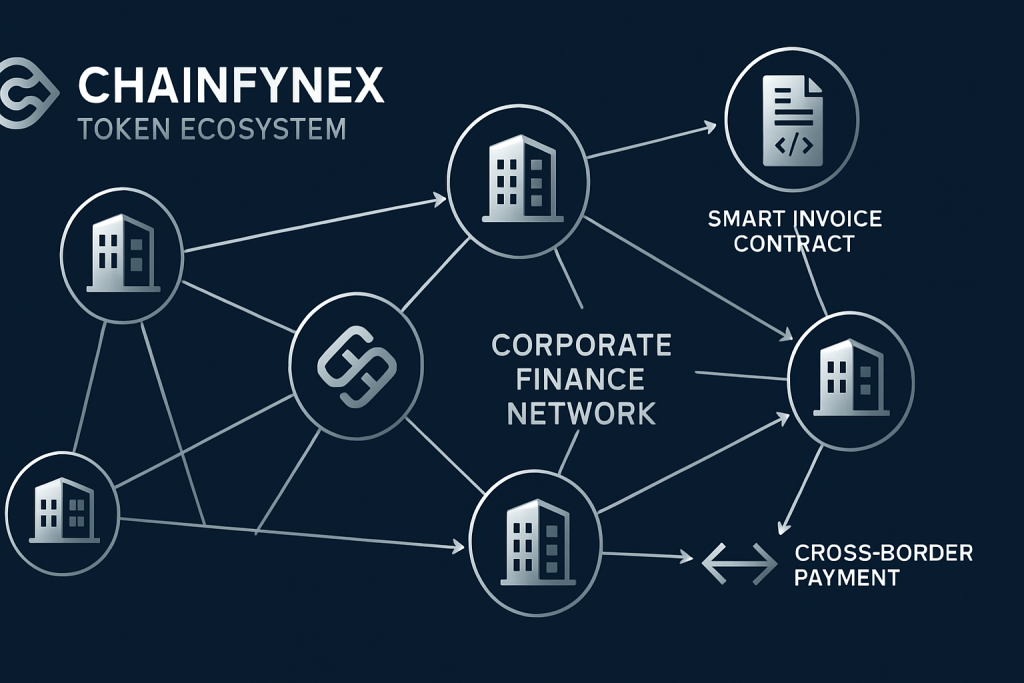

Corporate finance has long relied on outdated infrastructure: slow international payments, high transaction fees, manual invoice processing, and opaque supply chain financing. While decentralized finance (DeFi) has transformed retail crypto markets, the business-to-business (B2B) sector remains largely dependent on traditional banking rails built decades ago. Chainfynex Token emerges as a groundbreaking solution designed specifically for this gap—a utility token powering an ecosystem where companies, fintech platforms, and financial institutions can execute smart contracts, automate invoices, and settle cross-border payments instantly.

Unlike consumer-focused cryptocurrencies, Chainfynex Token addresses the unique needs of corporate treasurers, CFOs, and supply chain managers. By combining blockchain transparency with enterprise-grade compliance tools, Chainfynex creates a hybrid model that bridges DeFi innovation with traditional finance requirements. This article explores how Chainfynex Token works, its key features, and why it represents the future of on-chain corporate finance.

Why Corporate Finance Needs Blockchain Technology

Traditional B2B payment systems suffer from fundamental inefficiencies. International wire transfers can take 2-5 business days to settle, with unpredictable fees ranging from 1-5% of transaction value. Invoice financing and trade finance require extensive paperwork, manual verification, and multiple intermediaries—each adding costs and delays. According to recent industry analysis, outdated financial infrastructure like ACH networks and card processing systems were designed over 50 years ago and struggle to meet modern business needs.

Blockchain technology offers a compelling alternative. Smart contracts can automate payment conditions, eliminate reconciliation disputes, and create immutable audit trails. Tokenization enables fractional ownership of assets and instant transfer of value without traditional banking intermediaries. The global tokenized real-world asset (RWA) market has surged 160% in the past year to $36 billion, demonstrating accelerating corporate adoption of blockchain-based finance.

However, generic blockchain solutions often lack the specialized features enterprises require: KYC/AML compliance, regulatory reporting, integration with existing ERP systems, and governance structures aligned with corporate risk management. This is where Chainfynex Token provides critical infrastructure tailored specifically for B2B use cases.

The Origin Story of Chainfynex Token

Chainfynex Token was conceived by a team combining expertise in corporate treasury management, fintech product development, and blockchain architecture. After witnessing firsthand how Fortune 500 companies struggled to adopt blockchain due to compliance concerns and integration complexity, the founders recognized a need for purpose-built infrastructure.

The key insight was straightforward: businesses don’t need another speculative crypto asset. They need a functional token that speaks the language of corporate finance—invoices, payment terms, credit limits, audit trails—while leveraging blockchain’s core advantages of transparency, automation, and disintermediation. Chainfynex Token was designed from the ground up as the economic engine for this new B2B payment infrastructure, serving simultaneously as a settlement currency, liquidity source, governance mechanism, and incentive layer for network participants.

What Is Chainfynex Token?

Chainfynex Token is a utility token powering a specialized DeFi protocol for corporate finance and B2B payments. Unlike general-purpose cryptocurrencies, it is optimized for enterprise use cases including smart invoice processing, cross-border settlements, treasury management, and trade finance.

The token serves multiple critical functions within the ecosystem:

- Settlement currency: Companies use Chainfynex for payment settlements, particularly in cross-border transactions where traditional banking is slow or expensive.

- Staking mechanism: Network validators, liquidity providers, and fintech partners stake Chainfynex Token to participate in transaction processing and earn protocol fees.

- Governance rights: Token holders vote on key protocol parameters including risk limits, supported assets, compliance rules, and ecosystem fund allocation.

- Fee payments: All smart contract executions, invoice processing, and value-added services require Chainfynex Token for transaction fees, creating consistent utility demand.

Technically, Chainfynex Token is built as an ERC-20 compatible token with multichain support planned for Layer 2 networks to optimize transaction costs and throughput for high-volume corporate users.

Smart Invoice System: Automating B2B Payments

One of Chainfynex Token‘s most powerful features is its Smart Invoice System—transforming traditional paper or PDF invoices into self-executing smart contracts. This innovation directly addresses one of the largest pain points in corporate finance: invoice processing and payment reconciliation.

Here’s how it works in practice:

- Company A creates an on-chain invoice as a smart contract, defining payment terms, due dates, early payment discounts, and late payment penalties.

- Company B receives the invoice through the Chainfynex platform and can verify authenticity instantly via blockchain records.

- Upon delivery confirmation (validated through integrated logistics data or manual approval), the smart contract automatically triggers payment in Chainfynex Token or stablecoins.

- All parties maintain real-time visibility into invoice status, eliminating the need for manual follow-ups and reducing accounts receivable days outstanding.

This system significantly reduces administrative overhead, minimizes payment disputes, and accelerates cash conversion cycles. For businesses processing thousands of invoices monthly, the efficiency gains can translate to millions in working capital improvements.

Cross-Border Settlements with Near-Instant Finality

International B2B payments represent a $25 trillion annual market plagued by inefficiency. Traditional correspondent banking involves multiple intermediaries, foreign exchange spreads of 2-4%, and settlement times of 3-7 business days. SWIFT network improvements have helped, but fundamental limitations remain.

Chainfynex Token enables an alternative model for cross-border settlements:

- Companies hold Chainfynex Token and stablecoins in protocol-integrated treasuries.

- When payment is due, the smart contract executes near-instant settlement—typically within minutes rather than days.

- Foreign exchange conversions happen through decentralized liquidity pools with transparent, competitive pricing.

- Transaction fees are fixed and predictable, typically under 0.5% compared to 2-5% for traditional wire transfers.

Major financial institutions are already experimenting with blockchain-based settlement layers, including SWIFT’s shared real-time ledger connecting 30+ global banks. Chainfynex Token positions itself to integrate with these emerging rails while offering immediate benefits to companies that cannot wait for legacy institutions to complete their digital transformation.

Treasury Management and Yield Generation for Corporates

Corporate treasurers manage substantial idle cash balances—often earning minimal interest in traditional bank accounts while maintaining liquidity for operational needs. Chainfynex Token unlocks new treasury management strategies by providing access to DeFi yield opportunities designed with corporate risk profiles in mind.

Unlike high-risk DeFi farming strategies, the Chainfynex protocol offers conservative yield generation options:

- Low-risk staking pools: Companies can stake Chainfynex Token or stablecoins in protocol-secured pools with transparent, auditable returns typically ranging 3-8% annually.

- Invoice-backed lending: Treasuries can earn yield by providing liquidity for invoice financing, with returns backed by real commercial obligations rather than speculative crypto assets.

- Automated risk management: Protocol-level limits prevent excessive concentration, and CFO-friendly dashboards provide real-time portfolio monitoring and regulatory reporting.

This approach allows companies to incrementally allocate treasury funds to blockchain-based opportunities while maintaining the control, transparency, and compliance standards required by boards and auditors.

Compliance Layer: Bridging DeFi and Traditional Finance

Enterprise adoption of blockchain requires robust compliance infrastructure. Chainfynex Token addresses this through an integrated compliance layer that satisfies regulatory requirements without sacrificing blockchain’s core benefits.

Key compliance features include:

- Mandatory KYC/AML: All corporate participants undergo identity verification and ongoing monitoring aligned with international regulatory standards.

- Whitelisting and blacklisting: Companies can restrict transactions to pre-approved counterparties, essential for industries with strict vendor management requirements.

- Audit-ready reporting: Automated generation of transaction reports, tax documents, and compliance certifications compatible with major accounting standards.

- Jurisdiction-specific controls: Protocol supports geographic restrictions and regulatory adaptations for different markets, critical as digital asset regulations evolve globally.

This compliance architecture positions Chainfynex Token in the emerging “RegDeFi” category—decentralized finance infrastructure designed from inception to coexist with traditional regulatory frameworks rather than circumvent them.

Token Utility and Economic Model

Chainfynex Token derives value from multiple utility mechanisms that grow with ecosystem adoption:

Primary utility drivers:

- Transaction fees for all smart invoice processing, settlements, and value-added services

- Staking rewards for validators and liquidity providers securing the network

- Governance participation rights determining protocol evolution and risk parameters

- Access to premium features including priority processing, extended credit terms, and advanced analytics

Tokenomics overview:

While final distribution details remain subject to governance decisions, the economic model emphasizes sustainable long-term value creation:

- Fixed or controlled supply cap preventing inflation erosion

- Strategic allocation across ecosystem development (30-40%), team and advisors with multi-year vesting (15-20%), early supporters (10-15%), and community incentives (30-40%)

- Fee burn mechanism removing a portion of transaction fees from circulation, creating deflationary pressure as usage grows

- Staking requirements for network participants ensuring alignment between token value and protocol success

This structure ensures that Chainfynex Token appreciates as the ecosystem scales, rewarding early adopters and long-term participants while maintaining sufficient liquidity for operational use.

Governance and Risk Parameter Management

Decentralized governance through Chainfynex Token allows stakeholders to collectively manage protocol evolution. This is particularly important in corporate finance, where risk parameters and compliance requirements must adapt to changing market conditions and regulatory environments.

Token holders participate in governance decisions including:

- Credit limits and collateralization ratios for invoice financing and trade finance products

- Approval of new fiat currencies, stablecoins, and tokenized assets supported by the protocol

- Selection and oversight of price oracles and data providers ensuring accurate market information

- Risk concentration limits preventing excessive exposure to single counterparties or asset classes

- Allocation of ecosystem development funds supporting integrations, audits, and market expansion

Large ecosystem participants—corporations, banks, fintech platforms—are incentivized to accumulate and stake Chainfynex Token to influence protocol parameters directly affecting their business operations. This creates a governance model where decision-making power aligns naturally with economic stake and operational expertise.

Real-World Use Cases for Businesses and Fintechs

Chainfynex Token enables concrete business applications across multiple sectors:

International Supply Chain Management

A manufacturer in Germany invoices a retailer in Brazil using Chainfynex Smart Invoices. Payment terms are encoded in the smart contract: 30-day payment window with 2% discount for payment within 10 days. Upon shipment confirmation via integrated logistics data, the invoice activates. The Brazilian retailer pays in stablecoins, automatically converted through Chainfynex Token liquidity pools. Settlement completes in minutes rather than the typical 5-7 days for international wire transfers, improving working capital for both parties.

Trade Finance and Invoice Factoring

A factoring company uses Chainfynex Token to tokenize invoice portfolios, offering them to DeFi investors seeking yield backed by real commercial obligations. Investors purchase fractional ownership of invoice pools, earning returns as buyer companies settle payments. The protocol handles all disbursements, risk calculations, and compliance reporting. This opens previously illiquid factoring markets to global capital while providing businesses faster access to working capital at competitive rates.

Fintech Platform Integration

A B2B neobank integrates Chainfynex as its settlement backend, enabling clients to send international payments, automate invoice processing, and earn yield on idle balances—all without knowing blockchain operates behind the scenes. The neobank earns Chainfynex Token through transaction fees and staking rewards, creating a new revenue stream while offering superior service compared to traditional banking infrastructure.

Risks and Considerations for Adoption

While Chainfynex Token offers significant advantages, prospective users should understand the risks inherent in any emerging financial technology:

Regulatory uncertainty: Digital asset regulations vary significantly across jurisdictions and continue evolving. Companies must ensure compliance with local laws, and regulatory changes could impact protocol operations.

Integration complexity: Connecting blockchain infrastructure with existing ERP systems, accounting software, and banking relationships requires technical expertise and may involve temporary operational friction during transition periods.

Smart contract risks: Despite rigorous auditing, smart contracts can contain vulnerabilities. The protocol implements multiple security layers, but users should start with small-scale pilots to build confidence.

Governance concentration: Early stages may see governance power concentrated among large stakeholders. The protocol addresses this through delegation mechanisms and gradual decentralization roadmaps.

Market adoption pace: Network effects matter—Chainfynex Token becomes more valuable as more businesses join the ecosystem. Early adopters assume some risk that adoption may take longer than projected.

The Chainfynex team addresses these risks through phased rollouts, volume-limited pilot programs, continuous security audits, transparent communication of protocol limitations, and close collaboration with regulatory authorities in key markets.

Roadmap and Future Vision for Corporate Blockchain Finance

Chainfynex Token development follows a multi-phase roadmap designed to balance innovation with stability:

Phase 1: Pilot Program (Current)

- Limited launch with 10-20 carefully selected corporate partners

- Focus on smart invoice system and basic cross-border settlement functionality

- Intensive feedback gathering to refine user experience and compliance workflows

Phase 2: Geographic Expansion

- Addition of new currency pairs and regional stablecoin support

- Partnerships with regional fintech platforms and payment processors

- Integration with major ERP systems (SAP, Oracle, Microsoft Dynamics)

Phase 3: Advanced Financial Products

- Launch of invoice financing and trade finance marketplaces

- Treasury management tools with automated yield optimization

- Enhanced analytics and risk management dashboards for CFO offices

Phase 4: Full Decentralization

- Transition to community governance with broad Chainfynex Token distribution

- Open-source protocol components enabling third-party integrations

- Cross-chain interoperability allowing use across multiple blockchain networks

The long-term vision positions Chainfynex Token as foundational infrastructure for on-chain corporate finance—the standard protocol for businesses seeking blockchain benefits without sacrificing enterprise requirements for compliance, security, and operational reliability.

How Businesses Can Start Using Chainfynex Token

Getting started with Chainfynex Token involves straightforward steps designed for traditional businesses new to blockchain:

For companies:

- Register for the platform and complete enterprise KYC verification

- Connect existing accounting systems via API or use the web-based interface

- Start with a small pilot—perhaps one supplier or one international payment relationship

- Gradually expand usage as team confidence and operational experience grow

For fintech partners:

- Review integration documentation and technical requirements

- Establish partnership terms including revenue sharing from transaction fees

- Implement Chainfynex backend for specific use cases (payments, invoicing, treasury)

- Market enhanced services to existing client base, creating new revenue opportunities

For investors:

- Research token utility, governance rights, and economic model

- Acquire Chainfynex Token through supported exchanges once public trading launches

- Consider staking for governance participation and protocol fee sharing

- Monitor ecosystem growth metrics and corporate adoption announcements

Early participants benefit from ecosystem incentive programs, preferential staking rewards, and governance influence as the protocol scales. As corporate blockchain finance moves from experimental to mainstream—a transition already underway according to industry leaders —Chainfynex Token positions businesses to capture first-mover advantages in this transformative technology shift.